ECONOMYNEXT – Sri Lanka has recorded an 82 million dollar surplus in the external current account in November 2025, central bank data showed, with the rupee falling faster than the deficit month of October.

According to revised data, Sri Lanka had recorded a 199 million dollars deficit in the current account and 196 million dollars in September.

In September the rupee fell to 302.61 to the dollar from 302.45 to the dollar with a 196 million dollar current account deficit.

In October the rupee fell by around 2 rupees to 304.61 with a 199 million dollar deficit in the current account.

A deficit in the current account implies net inflows through the financial account – subject to errors and omissions.

In November 2025 with a surplus of the 82 million dollars of the current account, the rupee fell almost four rupees to the dollar to 308.03 to the US dollar.

A surplus in the current account implies an outflow through the financial account (similar to what some people refer to as ‘capital flight’).

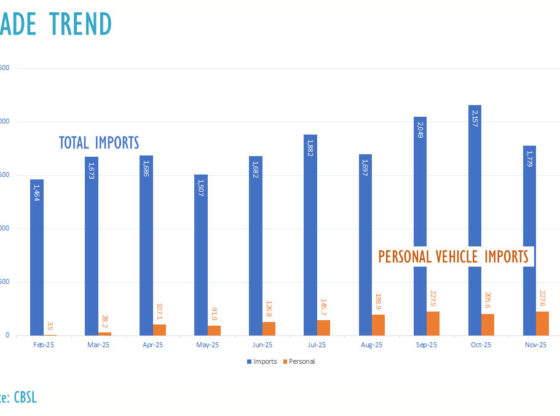

In November 2025, imports fell to 1,778 million dollars from 2,156.8 in October.

Sri Lanka has recorded current account surpluses in 2023 and 2024 with the central bank providing monetary stability to repay it own debt, the government’s and in some cases that of the private sector.

In 2025 the Sri Lanka had recorded a current account surplus of 1.7 billion US dollars, higher than the 1.2 billion in 2024.

However concerns are rising with flaws in the flexible exchange rate showing up in rapid depreciation, which will eventually undermine government and state enterprise finances.

However, the rupee fell from 292 in December 2024 to 308.03 by November and further to 309.50 by end December 2025.

RELATED : What is wrong with Sri Lanka’s flexible exchange rate

Analysts have blamed the inconsistent exchange rate policy ingrained in the ‘flexible’ exchange rate, which rejects classical economic principles of which sound banks of issue were operated, keeping the age of inflation, social unrest and sovereign defaults at bay.

RELATED : Sri Lanka’s exchange rate depreciation by ‘Political Ravishment’

Macro-economists and Mercantilists in the past have blamed current account deficits for external troubles and also budget deficits. But they no longer have the excuses.

When a central bank buys dollars in creates new money, a process which the central bank’s first Governor John Exter called ‘monetization’ of the balance of payments, new money is created.

Unless the liquidity is mopped up with deflationary policy, the central bank has to return the dollars at the same rate as they were originally bought to stop the rupee from depreciating when the new rupees turn into imports through the credit system or to debt repayments when the government asks for dollars by borrowing or taxing rupees.

While the central bank has returned dollars to the government, it did not initially return dollars to the private importers after dithering until the excess liquidity turned into imports.

The selective denial of the convertibility as well as the inconsistent regime (buying dollars through a pegging and denying dollars through floating rate style) also leads to confidence shocks (panic or uncertainty indicating weak credibility) forcing importers to cover early and exporters to sell late, analysts have pointed out.

Analysts have pointed out that exchange rates cannot be market determined, but is an outcome of the operating framework of the bank of issue involving the sum total of exchange and money policies.

There have been calls for the Treasury to buy dollars in the market and also charge taxes in dollars from those who can pay, removing a de facto priviledge granted to the central bank (Government Acceptance) to prevent a second default from inflationary policy.

If the central bank resumes inflationary policy to keep overnight or other rates down injecting liquidity either through open market operations (monetizing bank rupee assets) or buy-sell swaps (monetizing bank dollar assets) forex shortages could emerge on a net basis, analysts have warned.

Sri Lanka’s central bank has busted the rupee from 4.70 to 310 to the US dollar since its creation.

In 2004, the rupee strengthened after the tsunami as private credit collapsed in January. (Colombo/Jan01/2025)

Continue Reading