Please note that we are not authorised to provide any investment advice. The content on this page is for information purposes only.

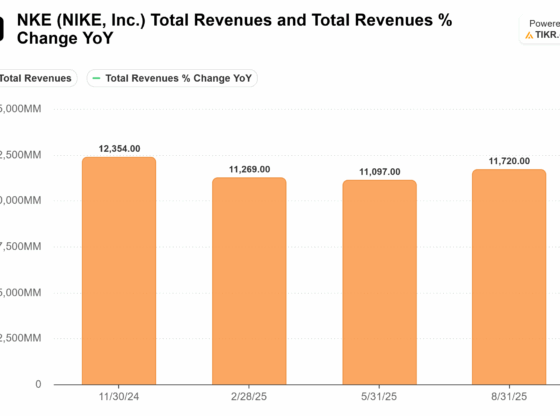

Nike stock (NYSE: NKE) is trading sharply lower in US price action today despite posting better-than-expected earnings in its fiscal Q2 2026, as weak guidance and continued decline in China sales took a toll on sentiment.

Nike reported revenues of $12.43 billion in the quarter, which was around 1% higher than the corresponding period last year and ahead of the $12.22 billion that analysts were expecting. The company’s gross margins fell 300 basis points to 40.6% in the quarter. Nike cited increased tariffs in North America as the primary driver of margin contraction. CFO Matthew Friend estimated that Southeast Asian tariffs alone would cost the company approximately $1.5 billion this fiscal year.

Nike Reported Better-Than-Expected Earnings

Moreover, Nike’s strategic pivot back to Wholesale (up 8%) at the expense of Nike Direct (down 8%) is a double-edged sword. While wholesale gets more products in front of customers, it carries significantly lower margins than selling directly through Nike.com or owned stores. To clear out surplus inventory of older styles (like the Air Force 1 and Dunk), Nike has engaged in aggressive discounting, further eating into the bottom line.

CEO Elliott Hill said that margin expansion is a “top priority” for the management team. He added, “While it will take time, we see the path back to double-digit EBIT margins for NIKE, Inc. That formula includes a multi-branded and diverse product portfolio that is constantly refreshing and bringing in newness, and seeking to drive value out of every relationship we have in the marketplace. It also requires us to be bolder and more creative in how we operate.”

Meanwhile, Nike’s per-share earnings came in at 53 cents, which was well ahead of the 38 cents that analysts had modelled.

Nike Reported a 17% Fall in China Sales

Nike’s North America revenues rose 9% to $5.63 billion. This was driven by a renewed focus on wholesale partnerships (like Dick’s Sporting Goods) and a stabilization of consumer demand for core footwear. However, that was offset by the continued woes in the Greater China region, where Nike’s revenues plummeted 17% to $1.42 billion. This marks the sixth consecutive quarter of decline in what was once Nike’s fastest-growing market. Local competitors like Anta and Li-Ning continue to erode Nike’s market share, and a cooling Chinese economy has curtailed discretionary spending.

Nike admitted that its performance in China was below par. During the earnings call, Hill said, “What we’ve done is a start, but it’s not happening at the level or the pace we need to drive wider change.” He added, “The next step is to further adapt our approach to fit China’s unique monobrand footprint and digital-first marketplace. The reset requires a fresh way of thinking from our NIKE teammates and our NIKE store partners, and it will take time.”

The performance of Asia Pacific and Latin America (APLA) and Europe Middle East, and Africa (EMEA) was mixed, though, with modest growth in Europe and the Middle East being offset by currency headwinds and softer demand in Southeast Asia.

NKE’s Guidance Underwhelmed

Nike expects revenues to be down low single digits in the current quarter while forecasting further gross margin contraction between 175-225 basis points. The guidance was weaker than expected and is weighing heavily on market sentiments today.

During the earnings call, Hill said, “Fiscal year ’26 continues to be a year of taking action to rightsize our classics business, return Nike digital to a premium experience, diversify our product portfolio, deepen our consumer connection, strengthen our partner relationships, and realign our teams and leadership.” Hill, who returned to Nike last year and took over the baron from John Donahoe, added“And I say we’re in the middle inning of our comeback.”

NKE Is Working On a Turnaround

Under Hill, Nike has pivoted to a turnaround strategy known as the “Win Now” plan. This initiative is a direct response to the brand’s recent struggles with declining innovation, loss of market share in performance running, and a “botched” over-reliance on direct-to-consumer (DTC) digital sales.

The strategy is designed to move Nike away from the “lifestyle fashion” focus of the previous era and back into a performance-first mindset. As part of the strategy, Nike is taking several actions. These include

- The “Sport Offense”: Restructuring the entire business around specific sports (Running, Basketball, Soccer, etc.) rather than generic consumer segments (Men, Women, Kids).

- Wholesale Re-engagement: Rebuilding broken relationships with retail partners like Foot Locker, JD Sports, and Dick’s Sporting Goods. Under the previous “Consumer Direct Acceleration” plan, Nike had pulled back from these partners, which inadvertently allowed rivals like On and Hoka to seize shelf space.

- Franchise Discipline: Reducing the supply of over-saturated “classic” models (Air Force 1, Dunk, and Air Jordan to restore their exclusivity and premium status.

- Innovation Acceleration: Speeding up the product pipeline to deliver “athlete-centered” technology, such as the neuroscience-based designs and powered running systems previewed in late 2025.

Nike Reshuffled Its C-Suite

In a major reshuffle earlier this month, Nike eliminated traditional executive “layers” to make the company faster and more tech-integrated. Eliminated Roles: Nike eliminated the standalone Chief Technology Officer (CTO) and Chief Commercial Officer (CCO) positions to integrate those functions more deeply into operations and finance.

These measures would help Nike streamline its business and lower costs. Meanwhile, for now, Nike stock continues to be out of favor with markets and has only extended its YTD losses following the fiscal Q2 earnings release.