ECONOMYNEXT – The International Monetary Fund has revised down Sri Lanka’s 2025 reserve projections, in a country report linked to an emergency loan, which analysts warned could happen due to rate cuts and strong private credit growth.

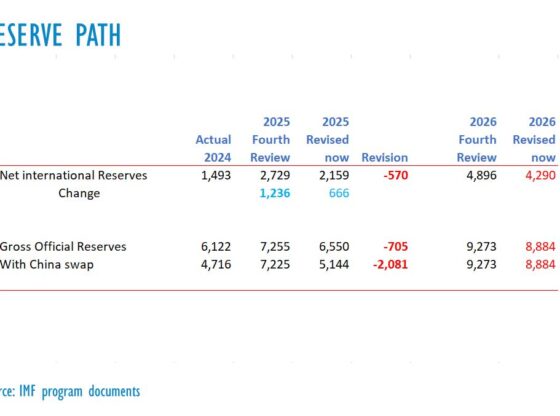

Net International Reserves which were expected to grow from 1,493 million US dollars in 2024 to 2,729 million dollars, at the last review, but would now grow to around 2,159 million dollars by end December.

NIR would still grow by 666 million dollars, down from 1,236 million dollars. The end December IMF program target is 448 million dollars.

Analysts had warned in general that any rate cuts based on historical inflation statistics, ignoring domestic credit growth would reduce the ability to collect reserves as the ability to buy dollars gradually reduced after a rate cut.

Sri Lanka was hit by Cyclone Ditwah in the last week of December. In December there is a likelihood that the central bank would be able to buy more dollars, analysts had said.

There have been repeated warnings that the current IMF program did not have a downward sloping net credit to government ceiling (deflationary policy) as a quantitative performance criteria and therefore the central bank’s ability to buy and retain reserves was constrained.

Attempts to collect dollars without sufficient deflationary policy (which is required to trigger a balance of payments surplus) would lead to currency depreciation, even if there is no actual balance of payments deficit.

Any inflationary policy, including central bank emergency liquidity assistance is likely to trigger BoP deficits, now that private credit is strong, analysts say.

In the last program which petered out by 2019, actual inflationary policy was carried out to suppress rates, leading to missed reserve targets, and waivers while depreciation discredited the elected government’s economic program as food and energy prices rose, leading to its ouster.

The Federal Reserve has halted quantity tightening and precious metals and base metals have started to surge. It is not clear whether food and energy prices will follow.

In Sri Lanka deflationary policy was limited in 2025 to coupons on the central bank’s bond stock and some bonds it had acquired outright during previous currency crises.

The central bank was collecting some dollars over 2025, which allowed it to repay its own reserve related liabilities, improving net reserves.

If the central bank does not conduct sufficient deflationary policy and allows excess liquidity to remain money markets until they become import credits, Sri Lanka’s ability to repay debt is reduced as the treasury does not buy dollars in the market or get dollar taxes.

Analysts have suggested that the Treasury be made independent of the central bank and allowed to charge dollar taxes (removing a Government Acceptance privilege) and that it also be allowed to buy dollars to repay debt.

RELATED

Sri Lanka Treasury should buy its own dollars to settle debt and avoid second default

Sri Lanka need not be a forex beggar nation, Treasury should charge dollar taxes

Sri Lanka to seek central bank dollars for debt repayment if IMF tranche delayed

In 2025 the Treasury had over-borrowed around 1.2 trillion rupees, a part of which could have been used to buy dollars and settle foreign debt if the central bank is unwilling to conduct deflationary policy or cuts rates to boost private credit.

“We are gradually rebuilding gross international reserves including through outright FX purchases in the market, supported by a non-interest current account surplus, new external financing and other non-debt creating inflows, and sovereign debt relief.

“We stand ready to undertake outright FX purchases on a net basis of US$2.65 billion between November 2024 and end-2025 to meet reserves target… the last IMF program said.

“We stand ready to undertake outright FX purchases on a net basis of US$2.65 billion between November 2024 and end-2025 to meet reserves target and another US$1.3 billion in 2026H1.

“We strive to save any overperformance in NIR accumulation. As a signal of our proactive approach to reserves accumulation, we have a cap on the adjustor for NIR target in cases of shortfall in project financing.”